Vehicle excise duty

Online Vehicle Verification. Motorcycles pay less and good vehicles pay more relative to.

Car Tax How Vehicle Excise Duty Works Nerdwallet

Getting your car taxed is your responsibility and something that.

. Web Vehicle Excise Duty VED commonly known as road tax applies to any road-registered vehicle in the UK. Web Electric vehicles EVs will no longer be exempt from vehicle excise duty VED from April 2025. Web This measure uprates the Vehicle Excise Duty rates for cars vans motorcycles and motorcycle trade licences by the Retail Prices Index from 1 April 2020.

Web Heres how to calculate duty on imported cars in Zambia. The rate of VED depends on a number of different. Web The excise rate is 25 per 1000 of your vehicles value.

Details published by the Treasury reveal that EV drivers will pay 165 a year for. Chancellor Jeremy Hunt announced that he wanted to make. As a rule cars vans and motorcycles with lower CO2 emissions also have lower vehicle tax rates.

Web Motor Vehicle Tax Property Tax Entertainment Duty Excise Duty Cotton Fee Infrastructure Cess Professional Tax. Web Vehicle Excise Duty also known as vehicle tax car tax or road tax is set to rise in line with inflation from April 2022 and will see the cost of owning a petrol or diesel. If your vehicle is.

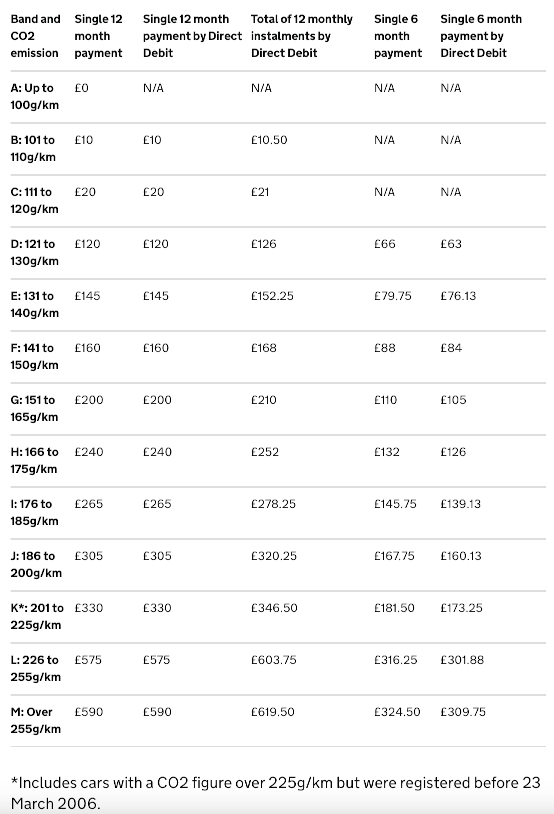

Web Vehicle Excise Duty tax rates divide into several DVLA vehicle tax bands. STEP 1 Enter Total Cost insurance and freight CIF STEP 2 Select Carbon Emission Surtax. Web This is commonly referred to as car tax or road tax but its actual title is vehicle excise duty VED.

Announcing the change as part of his Autumn Statement. A premium rate is charged for years 2-6 for models costing more than 40000 when. Web Electric cars will no longer be exempt from vehicle excise duty from April 2025 the chancellor has said.

Drivers pay road tax when they first register their car and then again either every six or 12 months. Web Electric vehicles will no longer be exempt from vehicle excise duty VED from April 2025 as part of key policy changes in the autumn statement. Web After the first year a standard rate applies to all cars with three core exceptions.

Web Excise duties are indirect taxes on the sale or use of specific products such as alcohol tobacco and energy. The revenue from these excise duties goes entirely to the country to. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged.

Web Vehicle Excise duty operates through a range of bands relating to the Co2 emission level and age of the vehicle. Web Electric car owners will have to pay Vehicle Excise Duty VED from April 2025. Web Vehicle Excise Duty is better known as road tax.

Dvla Vehicle Excise Duty Income Plunges As Tax Disc Axed Motor Claim Guru

Car Tax Everything You Need To Know About Vehicle Excise Duty Autocar

970 Excise Duty Stock Photos Pictures Royalty Free Images Istock

Car Tax Changes New Vehicle Excise Duty Rates Introduced Today Drivers Will Pay More Express Co Uk

Vehicle Excise Duty Uk 2019 Download Scientific Diagram

Vehicle Excise Duty In The Uk 2017 Statista

Pdf The Excise Duty Of Imported Cars Legal Problems

![]()

Vehicle Excise Duty Png And Vehicle Excise Duty Transparent Clipart Free Download Cleanpng Kisspng

Nearly Half Of People Would Support Road Pricing Survey

Forecasted Car Tax Income 2017 2024 Forecast Statista

Ved Definition Vehicle Excise Duty Abbreviation Finder

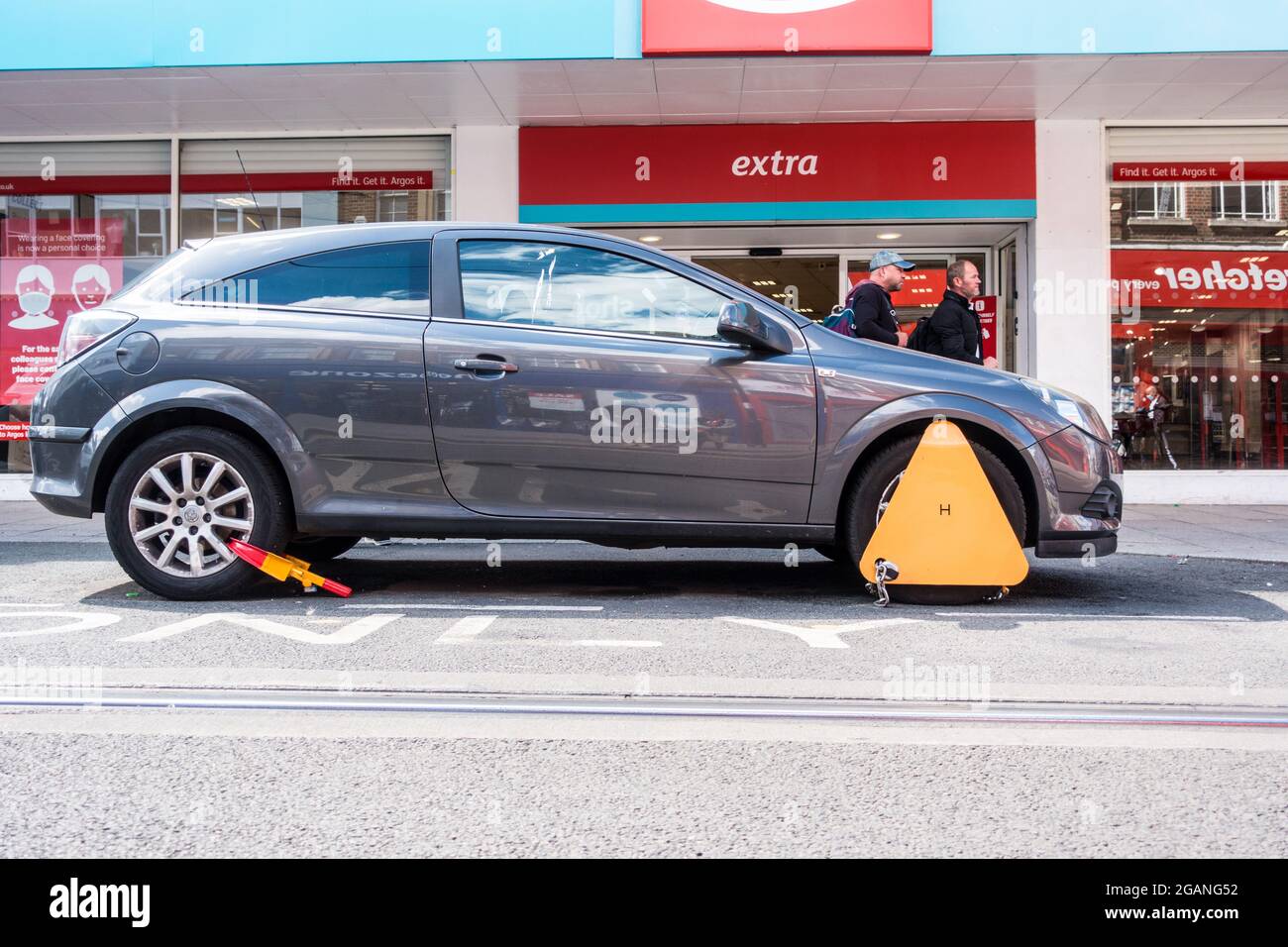

Small Grey Car Wheel Locked By Dvla Driving Vehicle Agency For Non Payment Of Vehicle Excise Duty Or Road Tax In England Stock Photo Alamy

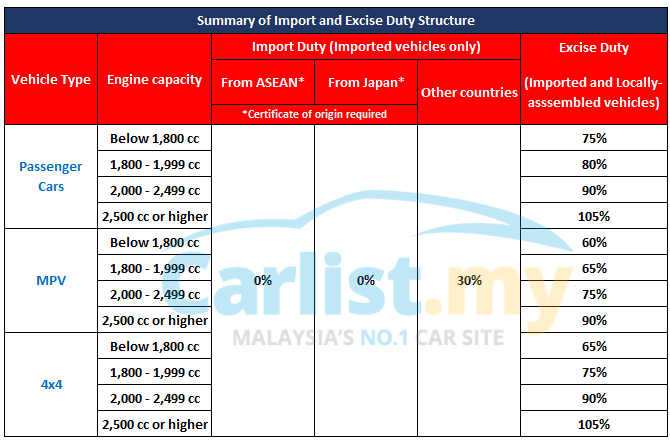

Government Mulls Lower Excise Duty For Cars How Low Will Prices Go How Realistic Is It Insights Carlist My

101 Vehicle Excise Duty Images Stock Photos Vectors Shutterstock